How to pick momentum stocks?

When one talks about investing or trading in general, the usual norm is to buy low and sell high. While this has been a widely accepted norm, momentum investing is the art of buying high and selling higher. Momentum stock investing is a completely different ballgame compared to regular investing.

Table Of Contents:

Richard Driehaus, is considered to be the pioneer of momentum investing where the premise is that

investors who wish to take higher risks in return for strong rewards can use momentum investing as a tool.

Momentum investing is based on Sir Isaac Newton’s first law of motion states that an object in motion continues to remain in motion unless acted upon by an external force. A simple example to this can be a car that is accelerating.

When the momentum or acceleration increases, the car starts to move at a faster speed. It continues to move at this speed but slows down when the acceleration or momentum starts to fade. A car, can of course screech to a halt when you hit the breaks.

Momentum investing is nothing different from the above example. The only variables here is that the acceleration or the momentum factor is the buying and selling activity.

A stock generates momentum, when there is a lot of activity, usually by institutional investors. This often leads the retail investors into the momentum buying or selling, to the point that the stock starts to rise or fall rapidly at least until the momentum fades.

Some of the best momentum stocks are those in the technology sector. These stocks are high growth stocks and some examples include Apple or Google or even Tesla. These stocks have a common characteristic in that they are fast to act and react.

Technically, momentum is used to explain the performance of a security. In terms of a quantitative risk factor, momentum measures how well a stock has performed and whether it will continue in the direction. Typically, momentum investors look at the stock’s most recent performance over a timeline of a quarter, a year or a 12-month performance.

Stocks that have fared well during such timeframes are classified as momentum stocks. Besides the technology sector, some mid-cap stocks also have the characteristics of being a momentum or a growth stock.

In order to pick momentum stocks, the first steps is in understanding what momentum investing is all about. It is obviously very different, and perhaps sits on the far end of the spectrum, when you compare to value investing for example.

At the same time, momentum investing is not to be confused with intraday speculation. Let’s explore more what is momentum investing.

What is momentum investing?

Momentum investing is a type of investment method that involves buying and selling securities that are most likely to see a significant appreciation or depreciation in prices in a short span of time.

With momentum investing, investors buy and sell securities that are above to break new grounds (new 52-week highs and new 52-week lows). The basic goal with momentum investing is to generate higher returns with a short span of time.

Under ideal conditions, momentum investing can often beat the benchmark indexes such as the S&P500 or the Dow Jones Industrials.

A momentum investor identifies such stocks that have a good growth potential within a short period of time. The timeframe is about 6-months to a year at best. Therefore, when compared to other forms of investing, momentum investing requires a more active approach to investing in securities.

Momentum stocks or growth stocks often lead the way when the markets are rallying. They are known to touch new 52-week highs and are often in the front page of news headlines. The strategy to invest in such stocks is based on capitalising on the existing trends.

A typical momentum investor aims to lock in the gains by riding the stocks that have shown a strong trend and are known to continue the trend within the timeframe mentioned. Industry insiders call momentum investing as basically a bet on stocks that have shown signs of being the next best performer.

What is momentum pick?

You might have heard the usage, momentum pick or momentum picks. These are nothing but stock picks based on momentum investing. Such stocks, which is often recommended to be not more than five at any point in time are stock picks that are best suited for momentum investing.

In recent times, momentum stocks have earned the nickname FAANG. FAANG stocks are a group of stocks made up of Facebook, Apple, Amazon, Netflix and Google.

The chart below gives an example of the performance of the FAANG stocks, which are basically momentum stocks over a time frame of year-to-date, 1 year, 3 year and 5 year returns compared to the S&P500 Index over the same period.

Figure 1: Momentum Stocks - Performance compared to the S&P500

Take the example of Amazon and Netflix, where the 5 yr and 3 yr returns have been above 125%. And in fact, Netflix beats the game, offering more than 375% returns over a 5-year period.

While the returns from momentum investing can be big, it involves investors to monitor the price of the securities on a regular basis. While this might sound easy, it is not that simple. Momentum stock investing can at times be misleading and cause frustration for the investor.

Imagine picking a stock that has rallied 15% in the past six months. This would lead the investor to pick some stake in such stocks, only to see the momentum fade in a few months time. This can lead to locked up capital and can be quite frustrating at times.

In order to have the best momentum picks, investors need to make use of the right set of tools. Unlike traditional investing, momentum investing requires a close mix of both fundamentals and the technical analysis of the securities.

Momentum investing can be very rewarding if the investor is able to master the tools of the trade. One of the biggest benefits of momentum investing is that you can play the markets both when the stocks are rising and when the stocks are falling.

How do you measure momentum?

Now that we know the level of rewards one can get by momentum investing, let’s get into the technical aspects of how to measure momentum. After all, the only way you can pick momentum stocks is by first being able to measure momentum.

Momentum, in financial markets is a measurement of the rate at which the price of a security rises and falls. Momentum is a useful tool for trend analysis as it can indicate the strength or the weakness in the trend. After all, you do not want to end up investing in a stock whose momentum is weak.

If you look at past data, you can clearly notice that momentum is more useful when the markets are rising rather than when they are falling. Typically, the stock markets tend to be more bullish than bearish. The bull markets tend to outperform the bear markets.

However, it is important to note that every momentum stock at some point started from being stationary. Just like a car starts from zero speed and then accelerates, this is the same case with momentum stocks as well.

Momentum investing is all about capturing the momentum after the car (or the security) started and closing your positions before the momentum ends.

The main goals with momentum investing is to use technical analysis to measure the strength of the momentum in an asset. The goal is to ascertain whether the momentum will continue or not. For this purpose, there are a number of momentum based indicators.

The most commonly used momentum indicators are:

- Moving average convergence divergence (MACD)

- Stochastics oscillator

- Rate of change (ROC)

- Relative strength index (RSI)

Momentum is of course measured by analysing the price of the security. The indicators that are used to measure momentum are based on whether the markets are oversold or overbought. Thus, momentum oscillators tend to sit in the lower or upper portion of a stock chart.

They often oscillate between fixed values such as 0 and 100 or +100 through - 100. When the momentum indicator rises or falls to these fixed values, it indicates that the momentum is rising or falling. Typically, a Relative Strength Index indicator (RSI) is seen as signalling that the markets are overbought when the indicator is above 70 and signals falling momentum.

Likewise, when the RSI is below 30 level, it indicates that the markets are oversold and therefore signals rising momentum.

Figure 2: Price Rate of Change (Facebook)

The chart above in Figure 2 shows an example of the Facebook stock with the 13 period Price Rate of Change indicator applied to the charts. You can see how the momentum rises and falls as and when the PROC indicator rises and falls to the 0-level, indicating positive momentum.

However, such measures of momentum are very relative. Looking to the chart in figure 2, the Price Rate of Change indicator suggests rising momentum when the indicator starts to rise from the 0-level. Likewise, the momentum indicator signals falling momentum when the indicator starts to slip to the 0-level. Momentum is said to ease when the Price rate of change indicator cuts below the 0-line.

Besides using the PROC or the RSI indicator, there are many other methods of measuring momentum. For example, using a short term and a long term moving average, investors can ascertain the momentum in a trend.

The moving average indicators of course are nothing but the average of the stock prices over the pre-set period. This is something that can also be seen from momentum indicators such as the MACD which uses the 12-day and the 26-day exponential moving average.

With the MACD, when the value is greater than zero, it signals that the momentum is bullish because the value of the short term EMA is higher than the value of the longer term EMA. Thus, investors use this information to ascertain that the momentum is rising.

Volume as an indicator of momentum stocks

Besides the technical indicators mentioned in the previous section, investors can also make use of another valuable piece of information known as volume. Volume is something that investors take for granted. It is something that is mentioned just about in any security that you trade.

However, interpreting volume is an art and unless the investor knows what they are looking for, it can be a useless tool. In this next section, we will explore the importance of volume and how you can make use of this additional indicator as a tool to validate the right momentum picks.

What Is Volume?

Volume is a measure of the number of shares that are transacted (bought or sold) in the security over a given period of time. Volume is usually measured by a time frame. This time frame can be generally a one-day period. For example, the daily volume indicates how many shares changed hands for a security.

Volume, when measure of a 5-minute chart tells you, how many shares changed hands for the security in a 5-minute time frame. Finally, you can also see volume on a tick by tick basis. Volume based on tick shows the number of shares that changed hand for price to move one tick (the minimum price change in the security).

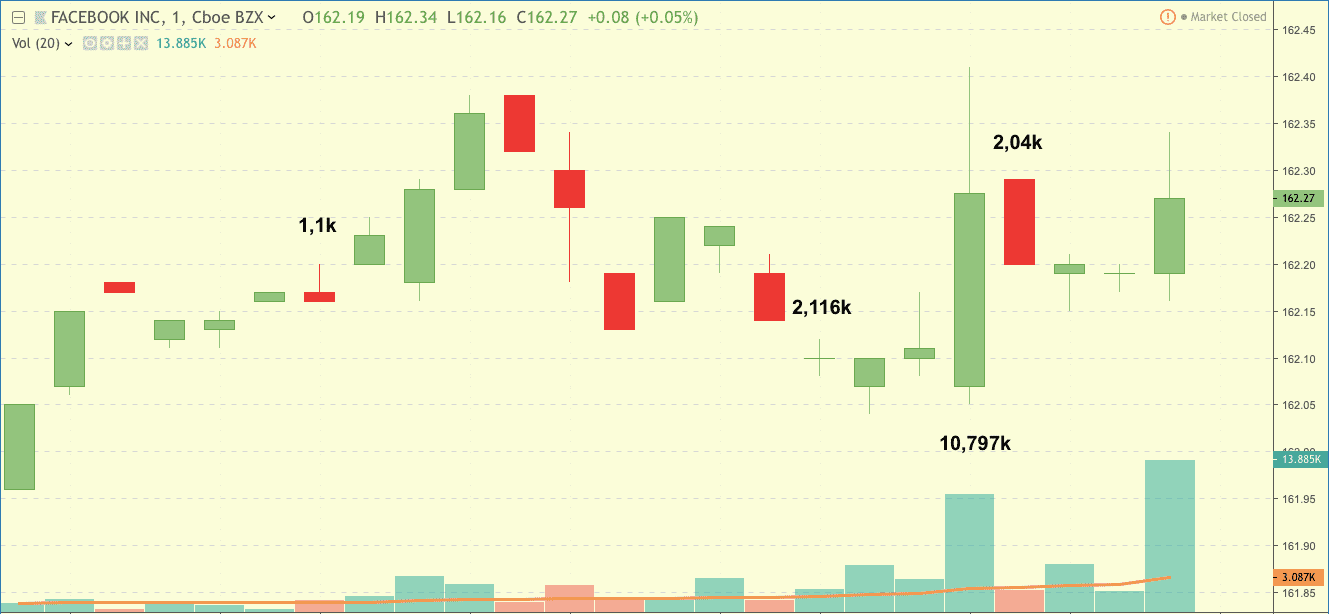

The chart below in Figure 3 gives an example of volume on a 1-minute time frame.

Figure 3: Volume on a 1-minute chart (FB)

In the above chart, we have randomly highlighted volumes. Starting from the left, you can see that the bearish candlestick saw prices turning lower, on just 1.1k volume with price range of $0,04.

On the other hand, the strong bullish candlestick that you see came across on 10,797k in volume. In this case, the range of the price was about $0,36 from the high to the low. Finally, the bearish candlestick on the right side shows volume of 2,04k. In this instance, the price change was just $0,09.

As you can see from the above, when there is heavy volume, the prices are also tend to move a lot. An interesting point to mention is that in the above chart, you should also consider the previous session’s closing price.

For example, the dojo candlestick you see has a volume of 2,116k. The price range for this candlestick was just $0,04. But if you look at the previous bearish candlestick, you can see the price gapped lower by $0,04. Therefore, when it comes to looking at volume, you need to look at the relative values.

When picking momentum stocks, you need to look at stocks that are trading above the average number of shares. Stocks that have higher than average volumes are those that tend to gap higher or lower on the open. This indicates pre-market or after-market activity that can indicate momentum is being built up in the stocks.

How To Find Momentum Stocks?

There are a number of ways that investors can find momentum stocks. The key is in combining the information from both fundamentals and technicals. Another key aspect about finding momentum stocks is to identify such stocks before hands.

Gaps are one way to find such stocks. Stocks that tend to gap by 4% or more indicates rising momentum. Gaps occur due to pre-market activity. This happens usually during earnings release or key announcements.

Companies generally release the earnings before the market opens or after the market closes. This allows investors to read through the earnings release and digest the information. Based on this, institutional investors tend to trade in the pre-market or after-market hours, leading to a lot of activity.

Looking at stocks that have higher than average volume will be the next step in identifying such stocks.

There are just a few steps when it comes to finding momentum stocks.

The first step is in using a series of methods to pick momentum stocks. Once you have a shortlist of momentum picks, the next step is to look at these stocks more closely from a technical perspective.

One of the strategies that investors can use the Richard Dreihaus strategy. The strategy gets its name from Richard Dreihaus who is the pioneer in momentum investing. Dreihaus stated that it would be more beneficial for investors to invest in a stock whose price is increasing at the risk of a decline, rather than invest in a stock that is already declining.

Based on his inputs, the American Association of individual investors (AAII) built a strategy where it choose the 50-day moving average as one of the criteria. The stocks picks were made based on the following criteria.

Divide the numerator (month end price of a stock - 50-day moving average price) by the 50-day moving average of the month end price.

A second filter was applied where the positive relative strength which is nothing but stocks having a 50% or more positive relative strength were chosen.

This basically meant that stocks that were trading above the 50-day moving average were select stocks that were prime for momentum investing.

Besides the above, some of the other criteria that investors should look to include:

- Stocks having strong earnings growth

- Stocks having strong earnings projection (strong forward guidance)

- Stocks that have a history of beating the estimates

You can build your own custom stock screener based on the above mentioned categories.

Figure 4: Stock screener for momentum growth stocks (Source: finviz.com)

The screener in figure 4 shows an example of a sample stock screener. The criteria used to short list the 17 stocks are based on profitable forward P/E, positive EPS growth this year and on a quarterly basis and with positive returns over the next five year period.

To ensure that the stocks are also not relatively new, another criteria added was to pick only stocks that were floated on the exchange 25 years ago. Finally, we focus on the large cap and higher market cap stocks on the NASDAQ exchange.

Once the shortlist is provided, investors can then look into each stock individually to get a more clearer picture based on technical analysis.

Pros and cons of momentum investing

As with any form of investing, momentum investing also has its pros and cons. For example, value investing has been made famous by Warren Buffet. However, value investing takes a lot of time and typically years to realise profits.

Secondly, investors need to be well capitalised when looking at value investing. Momentum investing on the other hand is more active and requires the investor to look at the stock performance at regular intervals. The risks are high, but so are the rewards with momentum investing.

Perhaps the most influential studies on momentum investing came from the book Returns to buying winners and selling losers: Implications for Stock Market Efficiency, published by Jegadeesh and Titman in 1993.

The book analysed U.S. listed stocks and found that the best performing stocks over the previous 12-month period continued to outperform the worst performing stocks into the next 12-month period. This was based on a study conducted on stocks from the years 1965 through 1989.

Further research showed that there was a significant effect from momentum on these stocks suggesting that it was not merely a product of data mining. Momentum stocks were identified based on the signal given during a six to twelve month period. However, the book cautions that there could be a few months of downturns or reversals in the stock price.

Following the release of the book, further studies were conducted in other markets including foreign stocks, commodities, currencies and even in bonds. The underlying result was always the same where stocks that showed momentum over the previous period tend to continue the same in the near term.

These findings led academicians such as Eugene Fama and Kenneth French who are strong advocate of efficient market hypothesis to agree that momentum affected just about any stock in question. Japanese stocks were the only exception to this. This can be found in their book, Size, value and momentum in international stock returns.

Giving an impetus to momentum investing is some new research from behavioural finance. This study into momentum investing from a behavioural point of view suggests that investors anchor their beliefs and are usually slow to update their views to new information.

A good example of this can be seen where stocks that beat estimates by a strong margin continue to give excess returns for a significant period of time after the earnings release. At the same time, stocks that miss the earnings estimates continue to underperform the markets for a significant period of time.

The field of Behavioural finance research shows that investors tend to engage in a form of mental accounting that is often irrational. This tends to contribute a lot to the over-reaction and under-reaction from investors to key information.

Investors are often reluctant to sell stocks that are losing in hopes that they could at least break even. But on the other hand, investors are quite to sell winning stocks only to lock in the gains. Such behaviour tends to impact the momentum stocks. Thus, when a trend is established, investors pile into the stock and continue to hold it, with their beliefs intact for some period of time.

While momentum investing looks good in theory and easy to implement with a bit of practice, in reality there are some factors that make this type of investing out of reach from many investors.

For one, momentum investing strategies have a high turnover which can be in excess of 100% in order for it to work. This leads to higher transaction costs that could potentially dent the returns from momentum investing.

When volatility increases, momentum stocks do not perform so well. Therefore, the momentum investing strategy can come under pressure and could eventually underperform the markets, which can be the most painful for investors.

An example of this can be seen during the 2008 global financial crisis. During such periods, value investing was seen to outperform due to the ability to pick discounted stocks which offer better returns in the longer term.

Secondly, regardless of the tools that investors use, it can be really difficult to always predict and be right about stocks that are about to exhibit strong momentum based growth.

Investing in momentum stocks - Conclusion

Momentum stocks can provide big rewards but at the same time they are risky. It takes a lot of practice and market knowledge to be able to pick the right momentum stocks. Due to the fact that the average holding period for momentum investing is one year, the returns can be easily measured.

Momentum based movements in the stock prices starts by a series of events. This results in increase interest from the investing community. Momentum stocks look quite the same from any other stocks, but there are some characteristics that make it very distinct from the rest.

By spending time and researching the stocks in order to pick momentum stocks can be a great exercise for investors to get started with momentum investing. Momentum is the reason behind the trends in the markets. And momentum can be measured by how strong prices move and general interest in the stock itself.

The trick to being successful with momentum investing is that investors need to be able to position themselves ahead of the big moves. This can be a fairly arduous task as it requires experience and expertise.

Momentum investing is not ideally suited for all types of investors. You need to be fairly tolerant to the risks that come with momentum investing. Therefore, investors having a conservative risk profile will find it difficult to be successful with momentum investing.