The three main types of trades

When it comes to trading, there is a good chance that your trading strategy falls into one of the three types of trading. While there is no way of telling as to which trading type is the best, it is important to note that the trader should understand what category of trading their trade falls into.

Table Of Contents:

Trading can be broadly classified into three types.

- The trend trades

- The counter trend trades

- The breakout trades

The above three types of trading are derived based on price action itself.

If you have any experience with trading, you would know that price does not move in a straight direction. Prices tend to move in a zig-zag fashion, posting corrections and then rallying and in between trading flat.

Each of the three types of trading requires a different set of rules, technical indicators and price action patterns.

Before we go into the details of the three main trading types, let’s look at the big picture. The chart below illustrates the different phases in a trend.

Main phases in a price of a securityThe above chart shows three main elements of the price action. The uptrend, the consolidation and the downtrend. Between these three main types, you can also see the counter cyclical moves or the counter trend trades.

From the above chart it should be easy to see how we can distinguish trading into three main types.

Let’s look at each of these trading types in detail.

The trend trades

The trend trade is where you trade in the direction of the trend. You can basically make us of any technical trend indicator to identify the trend. It is commonly known that the trend is your friend, and this couldn’t truer.

However, in reality, when you are actually trading, it is difficult to catch the trend until it has been established. This is why most trades try to capture the price tops and bottoms and end up losing money.

A trend is identified as where prices make higher lows in an uptrend or lower highs in a downtrend. On your screen, the uptrend is visually seen with price moving from the lower left side to the right upper corner.

In a downtrend, you can see price moving from the top left corner to the lower right corner.

The chart below shows an uptrend and a downtrend.

Example of downtrend and an uptrendAs you can see, on the left side you have the downtrend, where price has been steadily falling. To the right side, you have the uptrend which shows how price has been steadily rising.

Now comes the question of where to trade in the trend.

The best place to start is by first recognizing the trend. Remember that trends are relative. For example, on a one hour chart you might see a downtrend. But this could only be a correction when you switch to the daily char time frame.

Therefore, it is essential that you know what time frame you are trading. It is always recommended that you look at the trend of at least one higher time frame and then go back to a smaller time frame and trade in the direction of the main time frame.

To illustrate this point, let’s use a simple indicator such as two moving averages and see what comes out of it.

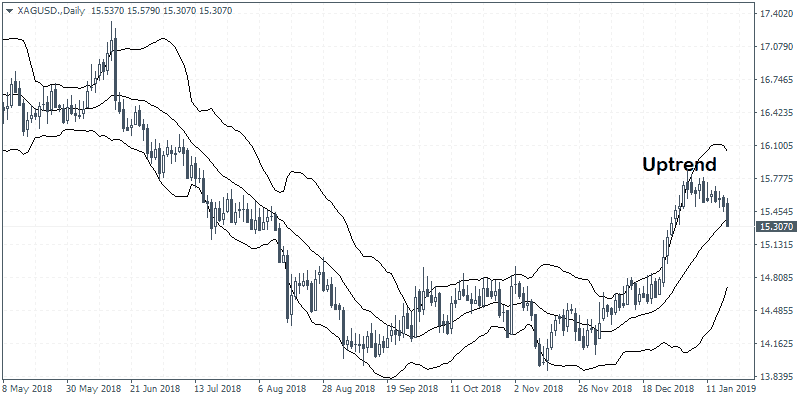

The first chart below is a daily chart of silver. You can see that price is in an uptrend.

Price in an uptrend on the daily chartNow that you know that the major trend is to the upside, you will now move to a smaller time frame to analyze the chart. In this example, we will look at the 4-hour chart time frame.

In the next chart below, you can see that how price action stalls on the H4 time frame and price starts to dip lower. On the chart, we also plotted the key resistance level that was broken. This resistance level gains a lot of importance because just prior to this breakout, we had an ascending triangle pattern.

The ascending triangle pattern is one of the breakout patterns that you will come across. We will also cover the breakout trade in the next sections of this article.

Ascending triangle breakout with no retestFrom the above price action, we can conclude that with the resistance level not being tested, price action is very likely to touch this level to form support.

While in the current time frame, the above looks like a downtrend, in reality, if you look to the daily chart, this is just a correction.

Therefore, to trade in the direction of the trend, you would be looking for price to establish support at the breached resistance level and go long once again, in the direction of the uptrend from the daily chart time frame.

What this method allows you to do is to pick the turning points in price. You can use your own methods to pick these corrections that commonly occur in a trend. Such kind of trades fall into the trend trading method and can offer some big rewards for swing trades.

The counter trend trades

In the previous section we showed how you can trade with the trend. But there is another way to trade which is a bit more risky but offers some big rewards nonetheless.

This is what is known as the counter trend trades. In a counter trend trade, as the name suggest, you trade in the opposite direction of the trend. This allows you to capture the corrections that prices make in a trend.

In an uptrend, a correction would be a reverse or the opposite, meaning that prices would decline.

In a downtrend, a correction would be that prices move in the opposite direction, meaning that prices would rally.

Trading the counter trend is risky due to the fact that sometimes trades can post a fake move. A fake move is when price tempts you into thinking that it is correcting, only to reverse and move back in the direction of the trend.

Counter trend trades tend to have strong moves. Therefore, you need to have good money and risk management principles in place.

Let’s look at some examples of counter trend trading.

Let’s start with the first chart. Here, we look at the daily chart with the 50 and 20 period exponential moving average.

Counter trend tradingIn the above example, we mark the strong part of the downtrend with the vertical lines to illustrate how counter trend trading works.

The next chart below scrolls down to the 4-hour chart where we also add the Stochastics oscillator to indicate the divergence as well as the 50 and 20 period exponential moving average to understand the prevailing trend on the chart’s time frame in question.

Counter trend trading with divergenceWhat we see in the above chart are two things.

Firstly, it is the divergence. The divergence is formed when the oscillator fails to mirror the highs and the lows in price. In the above example, as price makes a lower low, the Stochastics oscillator makes a higher low.

This is what is called divergence. In this scenario, the divergence indicates that prices would break to the upside.

To add more validity to this view, we add a falling trend line connecting the recent lows.

As you can see, after the divergence, price breaks this falling trend line and moves to the previously established support which now tuns to resistance.

If you look closely, the amount of time it takes for price to reach this resistance level is quite fast. Following the move to the resistance level, price then falls lower once again.

This is nothing but counter trend trading in action.

Divergence is one of the best ways to trade counter trend trading strategies. It can signal potential reversals. But of course, you need to make use of other technical indicators such as support and resistance in order to identify the potential target points and also where to place your stops.

The biggest advantage about trading counter trend is that it allows you to capture swift moves in the market. This means that you do not have to leave your trades open for prolonged periods of time, which is common when you trade with the trend.

The reason why counter trend trading can bring quick profits is the fact that trades tend to doubt their positions if they are trading with the trend. A weak position in the direction of the trend can be certainly affected by the corrective moves.

The breakout trades

The term breakout is used in technical analysis when prices have been in a congestion zone. In other words, this is also known as a sideways range where the pervious trend comes to a halt and prices just move sideways within a certain level, establishing a range.

Following this range, price tends to breakout leading to some big profits or a resumption of the trend or even a correction to the previous trend.

A sideways range is formed usually after a prolonged down trend or an uptrend. This is when price takes a pause and consolidates itself.

In technical analysis, a breakout can occur depending on how the consolidation takes place. For example, you can have a horizonal breakout. This is when price action moves within a horizontal range before breaking out.

A breakout can occur because price tends to take a pause after a strong trend. This is the time when price action remains trading sideways as it continues to accumulate a lot of orders.

Depending on the duration of the consolidation, the breakout can be swift and strong. Therefore, traders need to be very careful. If you are caught on the wrong side of the trade, and not trading without a stop loss you could see your losses accumulate quite quickly.

Let’s look at some examples of a breakout trade in the next sections.

Example of a horizontal breakoutIn the above chart you can see how price first posts a low and then bounces back. The low is tested a few times, but it not broken. Any bounce, off the low leads to price staying within the range. It also does not break the upside of the range.

Eventually price gives way and breaks to the downside, leading to strong price action. It should be mentioned that in this case, the previous trend was to the downside. So, it wasn’t surprising to see that the downside breakout resulted in a resumption of this previous downtrend.

Besides the horizontal breakout, you also have other patterns. For example, some of the famous consolidation patterns include the bullish or bearish flag patterns, pennant patterns, the more commonly occurring triangle patterns and so on.

The next chart below shows an example of a triangle pattern breakout.

Triangle pattern breakout ExampleIn the above case, you are looking at a silver price chart. You can see how prices basically remain flat but the consolidation leads to prices posting a lower high and higher lows, leading to the construction of the triangle pattern.

Since this pattern occurred at the end of the downtrend, the breakout to the upside resulted in a reversal in the medium-term timeframe. Following the breakout to the upside, silver prices briefly fell back to the breakout level before reversing the declines to push higher.

This is what is called as a pullback and can be an efficient way to trade the markets. The pullback doesn’t really matter where it happens.

A pullback can happen during a strong trend and also during sideways markets.

The main thing to bear in mind is that pullbacks offer a more safe and efficient way to trade the markets. But this is not always the case. Sometimes, breakouts can be strong that there will be no pullback at all. Therefore, if you were waiting for price to pullback, you would end up losing a good trade.

A typical way to measure the target is to find the difference from the range that was established and then project it from the breakout level. So, for example if you see a currency pair establishing a range of 200 pips, then your target would be a 200 pip from the breakout price level.

In conclusion, as you can see, the three different types of trading methods require different approach and risk tolerance. The most safest is of course, trading with the trend. But if you want to look at making more profits then the counter trend trades and the consolidation breakouts are the best ways.